Exploring the Varied Types of Cryptocurrency: A Comprehensive Guide

Written on

Chapter 1: Introduction to Cryptocurrency

Welcome to the second installment of our beginner's guide to cryptocurrency. Prepare to expand your knowledge about digital currencies.

If you haven’t seen the first part of our series, you can find it here.

Chapter 1.1: Understanding Cryptocurrency Terminology

To effectively navigate the world of cryptocurrency, it's important to grasp some essential terms. The most frequently encountered terms are “coin” and “token,” which are often misused interchangeably. However, this is not accurate.

Section 1.1.1: What Is a Crypto Coin?

A crypto coin is a type of digital currency that operates on its own unique blockchain (a digital ledger). Coins serve primarily as a means of value storage and facilitate transactions between parties. Notable examples include Bitcoin, the most recognized digital currency, and Litecoin, which is less prominent but still significant. Creating crypto coins requires both technical expertise and resources.

Section 1.1.2: What Is a Token?

In contrast, tokens do not possess their own blockchains; instead, they are built on existing blockchain platforms. Tokens are versatile and can serve functions beyond mere currency. For instance, they may act as identity verifiers or track products within supply chains. Additionally, tokens are increasingly used to ensure the uniqueness of non-fungible tokens (NFTs), though we'll delve into NFTs in a future discussion. Ether, used for transactions on the Ethereum network, is a prime example of a token-based currency. Tokens are generally simpler to create compared to coins.

Chapter 1.2: The Cryptocurrency Landscape

The surge in cryptocurrency prices has attracted numerous developers to the field. Consequently, the total number of cryptocurrencies has skyrocketed, with estimates ranging from approximately 4,500 to over 8,000, depending on the source. Regardless of the exact figure, the selection available is vast.

Chapter 2: Notable Cryptocurrencies

Bitcoin (BTC)

No discussion of cryptocurrencies would be complete without mentioning Bitcoin, the original digital currency launched in 2009. With roughly 18.5 million Bitcoins circulating, it boasts the largest community of developers and investors. Almost every major exchange supports Bitcoin, making it accessible for new investors. Moreover, prominent companies like Overstock.com, AT&T, and Starbucks accept Bitcoin as a payment method. However, Bitcoin has limitations, including slow transaction processing times averaging about 10 minutes and relatively high transaction fees.

Ethereum (Ether)

Launched in 2015, Ethereum transcends being just a cryptocurrency; it is a platform for developing decentralized applications and smart contracts, which automatically execute when specific conditions are fulfilled. Ethereum has garnered attention for its potential, but it is not without challenges, including scalability issues and reliance on outdated transaction validation methods.

Litecoin (LTC)

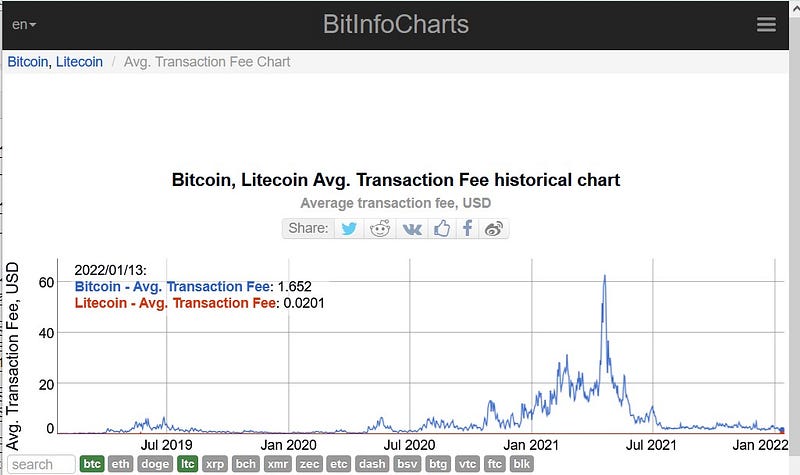

Created by a former Google employee and introduced in 2011, Litecoin aimed to address some of Bitcoin's shortcomings, such as slow transaction speeds and high fees. It has successfully reduced transaction times to approximately 2.5 minutes and offers lower fees—averaging $0.02 compared to Bitcoin's $1.65 as of January 2022.

Bitcoin Cash (BCH)

Bitcoin Cash emerged as a fork of Bitcoin, featuring a significantly larger block size (8MB compared to Bitcoin's 1MB). This allows for faster transaction speeds and lower fees. However, Bitcoin Cash faces challenges, including smaller returns, a lack of complete decentralization, and limited availability compared to Bitcoin.

Conclusion

While these four cryptocurrencies are among the most recognized, they are not necessarily the best. For instance, Ethereum is widely known, but lesser-known cryptocurrencies like EOS have addressed Ethereum's limitations, providing improved scalability and modern transaction validation mechanisms.

As you explore the cryptocurrency landscape, don’t restrict yourself to just these examples—who knows which cryptocurrency might become the next big thing?

Stay tuned for the third part of our series, titled “To Buy Cryptocurrency or Not to Buy Cryptocurrency: That Is the Question.”

If you enjoyed this content and want to explore more on Medium, consider subscribing through my referral link.

In the video "How Cryptocurrency ACTUALLY Works," you will gain deeper insights into the mechanisms behind cryptocurrency, enhancing your understanding of this digital asset landscape.

The video titled "Buying Every Crypto Currency (Again)" takes a closer look at the practicalities of investing in various cryptocurrencies, offering valuable advice for potential investors.