Essential Guidelines for Smart Investing: Maximize Your Returns

Written on

Chapter 1: Understanding the Basics of Investing

Investing serves as a means to generate income and enhance your assets. It goes beyond just the stock market, encompassing a variety of asset types, including real estate, art, cryptocurrencies, and even vehicles.

Engaging in investing carries its risks. It's crucial to grasp the fundamentals before you dive in. For instance, understanding your risk tolerance is essential. Moreover, familiarizing yourself with foundational investing principles will assist you in sifting through the abundant information available on the subject.

Section 1.1: Determining Your Investing Style

The first step in your investment journey is to identify what type of investor you aspire to be: active or passive. Active investors aim to outperform the market through personal strategies or advanced trading techniques like short selling and options trading. In contrast, passive investors trust in the long-term growth potential of their assets.

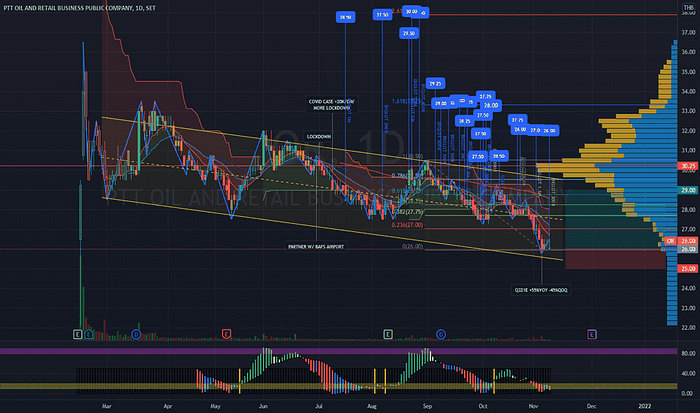

Active investing, often termed day trading, focuses on generating profits through frequent buying and selling of assets. These investors closely monitor the price fluctuations of their stocks or cryptocurrencies multiple times a day, utilizing advanced technical indicators that provide data on trading volumes and various price averages. The interface of an active investor may appear quite complex, and the discipline required for this approach is significant. Emotional control is paramount in this strategy.

As for passive investors, the aim is to hold onto assets for a longer duration—typically 1-3 years for short-term investments and over 3 years for long-term ones, depending on the security type. Some countries offer tax benefits for long-term investors; for example, in the Czech Republic, shares held for more than three years are exempt from capital gains tax.

Subsection 1.1.1: Risk and Reward Dynamics

Understanding the risk-to-reward ratio is fundamental to identifying your investor type. Balancing risk and returns is essential when selecting specific assets for investment. This approach doesn’t imply avoiding high-risk assets altogether; rather, it’s about finding a risk level that aligns with your comfort zone.

Section 1.2: The Importance of Diversification

"Diversify, diversify, and diversify!" is a mantra every investor should heed. Avoid concentrating your investments in a single asset. While excessive diversification isn’t necessary, having a varied portfolio can significantly mitigate risks. The rationale is straightforward: if one company fails, you still have numerous other investments to safeguard your financial health.

Chapter 2: Strategies for Effective Portfolio Management

Rebalancing your portfolio should occur at least annually, or whenever there is a significant market shift (20%+). This involves selling shares that have performed well and purchasing those that haven’t, thus maintaining your desired asset allocation.

To illustrate, if your portfolio consists of four assets each making up 25%, withdrawing one full 25% to invest in another asset could greatly alter your intended strategy. Adhering to your original investment goals is crucial.

The first video titled "How to Invest: 5 Effective Investing Principles" elaborates on essential strategies for successful investing, focusing on practical tips and long-term wealth growth.

The second video, "7 Timeless Investing Principles That Never Change," discusses enduring principles that can help guide your investment decisions and strategies.

Keeping expenses minimal is another significant factor. Many investors underestimate the impact of even a slight increase in expenses. A mere 1% difference can lead to substantial long-term effects. It’s wise to select a broker with low fees and be aware of your country’s tax regulations to maximize available tax advantages.

Conclusion

Embarking on an investment journey can be daunting initially. However, it offers a viable path to wealth accumulation. Understanding potential risks and working to minimize them through these essential principles is vital.

Select an investment strategy that resonates with you, keep your portfolio diversified, and rebalance as necessary to align with your established allocation. With time and discipline, your investments may provide you with a passive income stream, akin to concepts discussed in my article on the 4% rule.

For more insights, visit my website: http://helpwithpenny.com/