# Lessons Learned: My Crypto Journey and How You Can Benefit

Written on

Understanding the Crypto Landscape

The cryptocurrency realm remains a puzzle for many, and I was no exception. My lack of knowledge and hesitance to educate myself resulted in a significant loss of potential earnings. Don’t repeat my errors.

Let me transport you back to 2017, a year marked by the surging popularity of ICOs (Initial Coin Offerings). New cryptocurrencies were emerging at an astonishing pace. I was convinced this was merely a bubble, destined to burst once enthusiasm waned and funding dried up. My reasoning stemmed from the belief that there was no intrinsic value in these ventures—at least that’s what I thought. Consequently, I opted for minimal investment, mainly in Bitcoin.

In 2018, my predictions materialized: the bubble indeed burst, leading to plummeting prices for numerous projects. It became evident that many ICOs were merely vehicles for companies seeking funds that would never materialize into viable products.

When whispers of a crypto resurgence surfaced in 2021, I dismissed them, fueled by my past experiences. This choice turned out to be a grave misjudgment. My friend, however, took a different route; he approached crypto with curiosity, conducted thorough research, and by the peak of the market in 2021, he had amassed $400,000 from an initial investment of about $15,000.

He recognized the inherent value of cryptocurrencies, the disruptive nature of Web3, and how it operates as a new class of assets. After engaging in discussions with him, researching the field, and eventually securing a job as a software engineer in a Web3 company, I began to realize the gaps in my understanding. My goal moving forward is to equip you with the knowledge I lacked to prevent similar mistakes.

The Evolution of the Web: A Brief Overview

To truly understand the cryptocurrency sector, one must grasp the concept of Web3 and its transformative impact on the internet. Here’s a concise summary:

- Web 1 (90s - 2010/11): Characterized by static pages with limited interactivity, this was an era dominated by content creation from organizations with little user engagement.

- Web 2 (2010s - Present): Marked by significant centralization, where large entities control data. This era birthed social media and fostered user-generated content, but limited control for users.

- Web 3 (2018 - Present): This phase champions decentralization, allowing users to own their data and engage in systems without gatekeepers. For instance, Web3 payment applications require no personal information, promoting unrestricted transactions.

For a deeper dive into decentralization versus centralization, take a look at Ethereum's article comparing Web3 and Web2.

The fundamental principles of Web3—decentralization and data ownership—are gaining traction, prompting significant innovation and financial backing. For instance, Binance recently raised $500 million to invest in Web3 startups.

Cryptocurrencies play a crucial role in the expansive Web3 ecosystem, primarily serving as utility tokens for various platforms.

Utility and Value Proposition

A cryptocurrency’s true worth lies in its utility, the use cases it supports, and the projects it is associated with. To illustrate this, let's consider Nexo.

Nexo operates as a Web3 lending platform, allowing users to deposit funds and either lend or borrow against them—essentially positioning itself as a modern digital bank with interest rates reaching up to 12% on traditional fiat currencies.

To unlock these higher rates, users must maintain a certain percentage of Nexo’s token in their portfolio or receive interest payments in that token. This creates utility for the token, influencing its demand and supply dynamics. Unlike mere hype, Nexo's economics demonstrate that its token serves a genuine purpose within a valuable ecosystem.

In summary, a successful cryptocurrency acts as a utility within a broader system that provides tangible benefits to its users. Failing to grasp this concept contributed to my missed opportunities.

The Role of Smart Contracts

Another area where my understanding was limited was smart contracts—their capabilities and potential applications.

Smart contracts, stored on blockchains, are self-executing agreements that activate when predetermined conditions are met. They are immutable, meaning once deployed, they cannot be altered, and are accessible for anyone to view.

These contracts bring forth revolutionary possibilities, capable of transforming various industries by eliminating intermediaries through transparent, coded agreements. This not only reduces costs for organizations but also streamlines processes for all involved.

In the NFT space, for instance, artists can embed resale clauses within their artwork, generating additional income streams.

The potential applications for smart contracts are vast, spanning legal frameworks, real estate, insurance, and beyond. Imagine a property developer incorporating a 1% resale clause in newly built homes, benefiting financially from future sales.

The point is, countless use cases for smart contracts await discovery. Over the next few years, as these applications emerge, we'll see new cryptocurrencies and projects designed to tackle these challenges—these are the ones to monitor closely, as they may become the giants of the Web3 landscape.

Recognizing the Industry Cycle

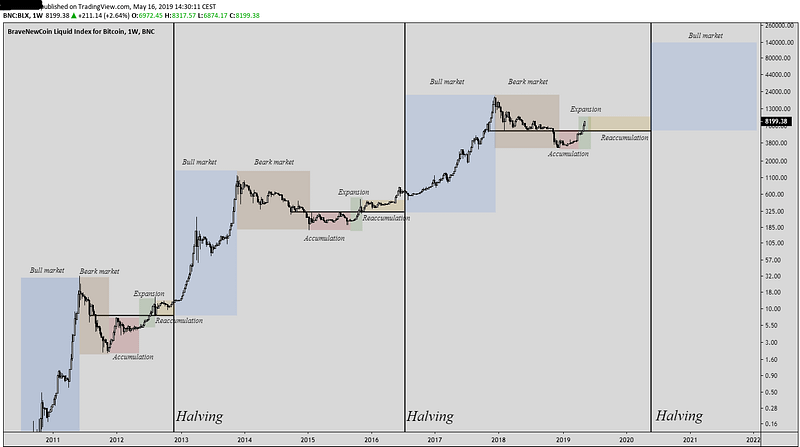

I previously mentioned a 3–4 year timeframe; this is no coincidence. The cryptocurrency market closely follows Bitcoin's halving cycle, occurring every four years.

To clarify, the Bitcoin reward for miners is halved every four years, consequently reducing supply. Assuming demand remains steady, price increases typically follow. Additionally, altcoins tend to mirror Bitcoin's price movements, as demonstrated in the accompanying chart.

My friend recognized this trend early on. Understanding these cycles allows you to prepare effectively, positioning yourself ahead of the curve. My friend's journey began around Q3 2020, just before the significant growth phase commenced, well before it hit mainstream headlines.

As of late January 2022, the crypto market entered a bear phase. With recession fears looming, further price declines are likely. However, keep in mind that after this potential downturn, another halving is on the horizon, paving the way for future opportunities.

The Impact of Major Adoption

Another critical factor I overlooked was the adoption rate of crypto projects, currencies, and applications. During the initial Bitcoin cycles, companies focused on building their foundations for the next surge.

For example, Nexo launched in 2018 at the tail end of a cycle, investing heavily in platform development. This strategic move set the stage for its explosive growth during the 2020-2022 bull run, culminating in 4 million users.

The past two years have witnessed a surge in decentralized finance platforms like Nexo, leading to substantial product adoption. The next four years are likely to see further growth in DeFi, NFT adoption, and new decentralized applications across various sectors.

Major corporations, including Tesla and Square, are now holding Bitcoin on their balance sheets, and the emergence of a Bitcoin spot ETF is imminent, particularly as regulatory clarity increases, enticing billions into the market.

Adoption is not limited to large enterprises; developing countries are also embracing cryptocurrencies. Research from Chainalysis highlights a significant share of total internet traffic directed towards crypto-related sites in these regions.

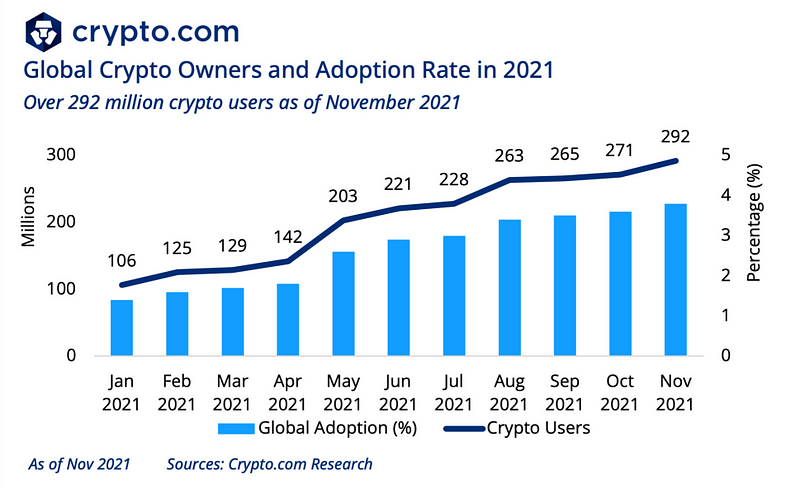

Looking ahead, projections suggest the number of crypto users could reach 10% of the global population by 2030, with current figures standing at approximately 292 million, or around 5%.

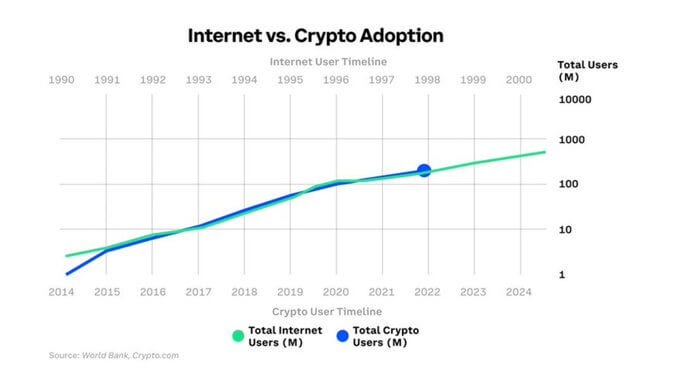

This growing adoption will drive further innovation, similar to what my friend uncovered before 2021. The pace of crypto adoption is reminiscent of the early days of the internet.

The Technology Revolution: Parallels with the 90s

We are currently experiencing a technological revolution akin to the 1990s, which led to the dot-com crash.

Allow me to elaborate: There are numerous overvalued tech companies trading at inflated price-to-earnings ratios, many of which are not profitable. The rise in living costs, coupled with high inflation rates, suggests we may be heading for a downturn.

While many are apprehensive, I remain optimistic and excited, as this spells opportunity—much like those who invested in Google, Amazon, Apple, and eBay during the 90s.

Returning to crypto, every digital currency is linked to a project or company. If a cryptocurrency lacks a solid foundation, it's best to steer clear. Many of these projects will emerge stronger from the impending corrections, potentially becoming the Amazon, Google, or Apple of Web3.

If I had conducted thorough research, I might have discovered opportunities ahead of time, just like my friend did.

Identifying Future Opportunities

Given all that’s been discussed, what should you focus on? Here are several industries increasingly adopting Web3 technologies that serve as excellent starting points for further exploration:

- Gaming: The integration of NFTs in gaming is gaining traction. Projects that enable companies to leverage NFTs and other Web3 concepts are worth investigating. Recently, EA’s CEO highlighted that “NFTs will play a significant role in the future of gaming.”

- NFTs in General: Applications range from real estate transactions to ensuring the authenticity of high-value products, like luxury watches.

- Artificial Intelligence: The potential for Web3 to foster intelligent decentralized applications and protocols.

- Decentralized Finance: This space is still evolving, with many new options emerging.

- Infrastructure Development: Companies that facilitate the creation of Web3 products, such as The Graph, are promising candidates for significant returns.

- Secure Wallets: Innovative wallets that prioritize security will likely emerge as pivotal tools.

For deeper insights, consider reviewing venture capital reports to see where investments are flowing.

Conclusion: A Path Forward

Ultimately, had I engaged in the research I’ve outlined, remained open-minded, and taken proactive steps, my financial position could be markedly different today—perhaps I could have also achieved that $400k milestone.

While the cryptocurrency space is indeed volatile and fraught with risks, it is still in its infancy, presenting immense opportunities for those willing to explore.

The key is to educate yourself, conduct thorough research, and identify projects you can comprehend and confidently support, all while being prepared to navigate the inevitable ups and downs.

I hope this reflection proves helpful and I wish you the best on your journey.

This first video, titled "I LOST $1000'S IN BITCOIN! 5 IMPORTANT TIPS FOR CRYPTO BEGINNERS!" offers valuable insights for those just starting out in the crypto world. It discusses common pitfalls and essential tips to avoid losing money in cryptocurrency investments.

The second video, titled "Do This Every Morning To Make Easy Money ($250/day)" shares strategies for generating passive income, particularly in the crypto space, making it a must-watch for aspiring investors.