Navigating the Earnings Landscape: Insights from Alphabet & Meta

Written on

Chapter 1: Earnings Overview

It’s that time of the quarter again—earnings season! Today, we’ll explore the latest updates from Alphabet and Meta. What insights can we glean from their recent performances about their present and future trajectories? What do these figures suggest about the broader technology and advertising sectors?

The key takeaways from Alphabet’s Q3 2022 earnings reveal that revenue is still on the rise, boasting a 6% year-over-year increase despite foreign exchange headwinds. Google reported an 11% growth when adjusted for constant currency. However, this is a significant slowdown compared to the staggering 41% growth seen in Q3 2021, leading to a nearly 10% drop in Alphabet's stock prices in reaction to the results.

In a recent analysis, Microsoft CFO Amy Hood noted that declining advertising spending impacted search and LinkedIn marketing solutions later in the quarter. Additionally, Snap’s stock plummeted by 25% after announcing its quarterly results. Snap's CEO, Evan Spiegel, criticized the metaverse, stating that after a long workday, he prefers not to "live inside of a computer."

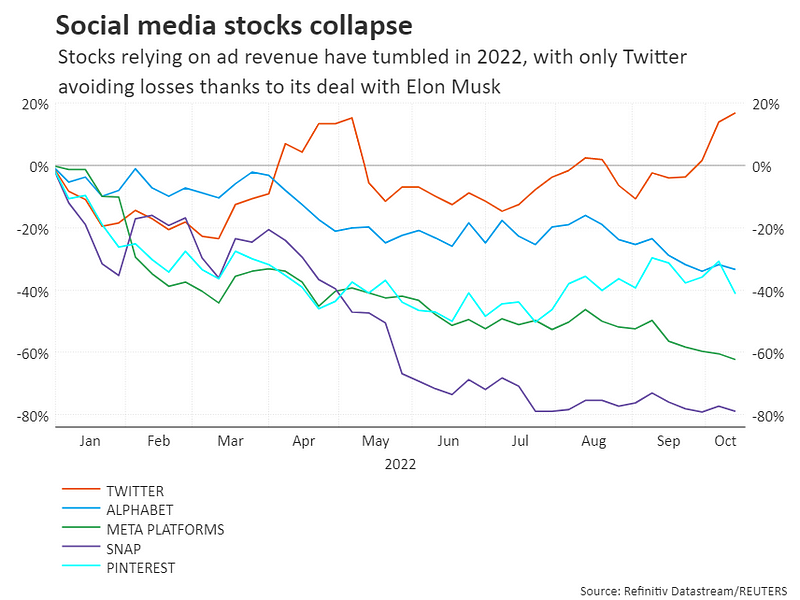

Here’s the broader perspective on digital advertising stocks this year:

Alphabet’s Earnings per Share (EPS) came in at $1.06, down from $1.40 in Q3 2021, and falling short of the expected $1.25 for Q3 2022. Despite this, Google continued to expand its workforce, adding 13,000 employees in the third quarter.

Mark Mahaney, an analyst from Evercore ISI, remarked, “It’s surprising that Google kept hiring and investing aggressively in Q3 despite deteriorating macro trends.” Alphabet attributes some of the disappointing results to currency fluctuations, alongside competitive pressures from platforms like TikTok, the challenging economic climate, and ongoing investments in AI expected to yield benefits in the future.

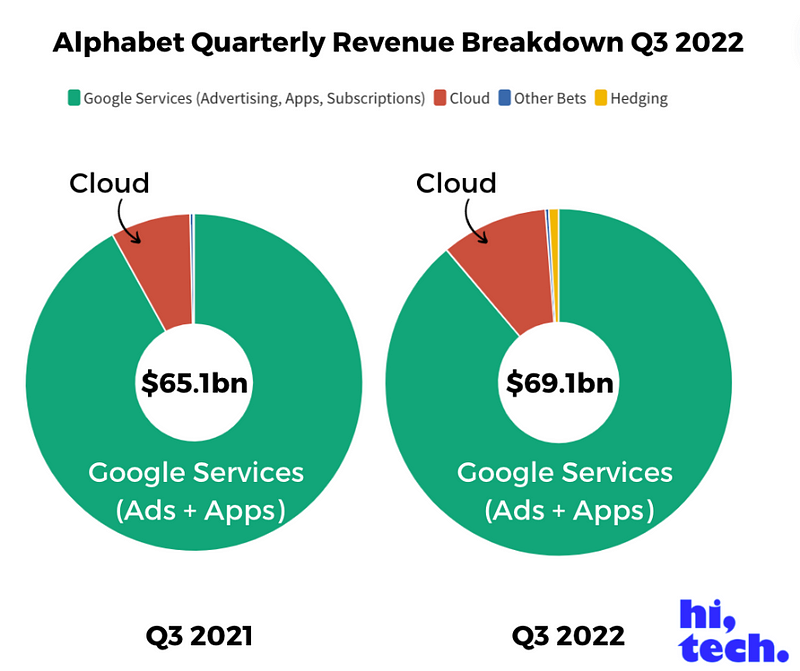

While US growth remains steady at 12% year-over-year and 2% quarter-over-quarter, the Asia-Pacific and EMEA regions saw declines of 2% each. Notably, the cloud segment now constitutes 9.9% of Alphabet's total revenue, up from 7.6% in Q3 2021, leaving advertising revenues still a major source of income.

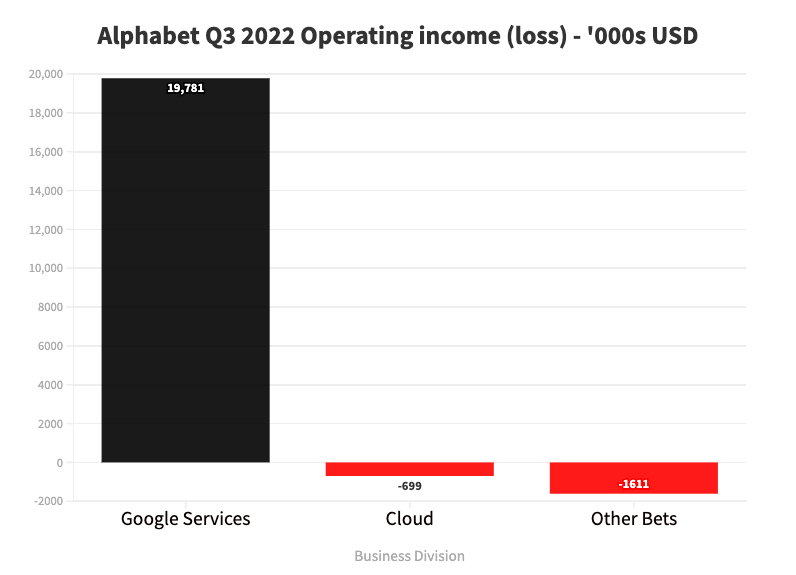

The “Google Services” category is primarily driven by advertising, which accounts for 90% of total services revenue. While Google Cloud is expanding rapidly, it continues to operate at a loss:

Alphabet can sustain its model for a while longer due to consistent growth in services revenue and a robust $16 billion in free cash flow. Similar to Amazon, which leveraged the profitability of AWS to bolster other sectors, Alphabet's core remains its advertising division.

Nevertheless, after seven years since Google transitioned to Alphabet, the company primarily still relies on Google ad sales with only a few exploratory ventures. While some initiatives like AI may enhance core operations, they don’t seem to be generating significant new growth opportunities.

The pressing question remains: How much longer can the core Google business be effectively leveraged? Regular readers of my analysis know there are considerable challenges ahead. The phasing out of third-party cookies poses potential risks, and new competitors are emerging from various sectors, including Netflix, Walmart, and TikTok. Additionally, reduced consumer spending is already impacting major advertising firms.

It appears that the golden era of effortless growth for digital advertising companies may be nearing its end. For over a decade, substantial advertising budgets have been shifting to digital platforms. We might be heading towards a zero-sum game where continuous growth for every player is unsustainable.

In light of Q3 results, Alphabet has indicated it will concentrate on its primary revenue-generating services, particularly search advertising. If Google's sales team offers “performance-boosting advice” in the coming months, be cautious; they may be driven by incentives to maximize client spending regardless of the actual effectiveness of their recommendations. The opacity of advertising products means you might not discern whether their strategies yield tangible results, although their self-reported “ROI” could appear favorable.

I also ponder whether a competitor could genuinely disrupt Google Search. This massive, ingrained business remains a staple in our daily lives, albeit its efficiency is up for debate. With advancements like GPT-3, could it be time to rethink our approach to search? This topic warrants further exploration, yet it’s increasingly plausible that a new contender could transform how we access information online.

Alphabet is also looking to monetize YouTube Shorts, its answer to TikTok. However, TikTok's established success in this area poses a challenge, especially with Meta prioritizing its Reels product for the upcoming year. There’s only a finite amount of short video content viewers can consume, and they are already deeply engaged with TikTok.

In this competitive landscape, YouTube and Facebook seem to be vying for second place, hoping that regulatory actions might hinder TikTok’s dominance. If that occurs, users may migrate to alternative platforms.

Despite not being a financial analyst, it’s captivating to compare Alphabet with Meta. Just months after Facebook transitioned to Meta, it seems to reflect a more deliberate strategic shift than Google’s Alphabet rebranding.

Chapter 2: A Comparative Analysis of Meta

The first video, "Alphabet 2022 Q3 Earnings Call," provides an in-depth look at the financial results and strategic direction of Alphabet. Insights from this call can help us understand the company's priorities and future plans.

Meta's financial situation is concerning, with net income plummeting by 52% year-over-year from Q3 2021 to Q3 2022. Its operating margin has consistently decreased each quarter, from 41% in 2020 to just 20% in Q3 2022.

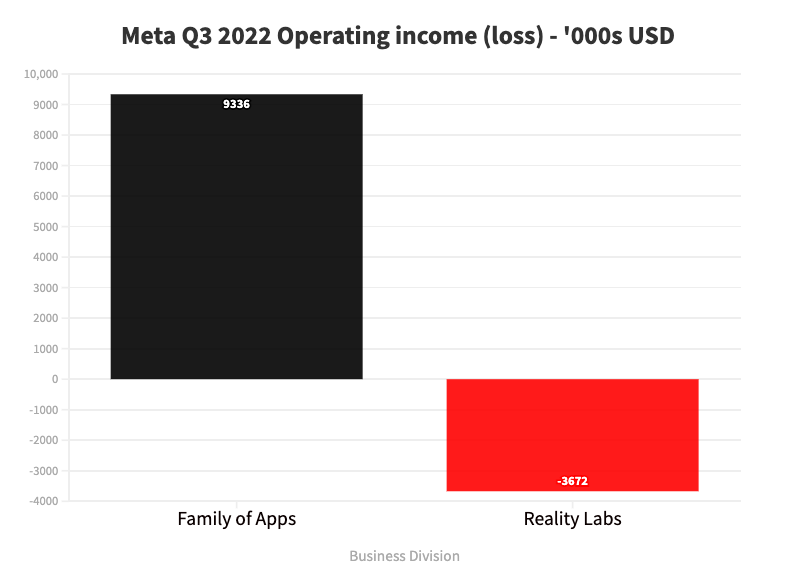

Moreover, let’s analyze the income and losses within Meta’s “Family of Apps” (which includes Facebook, Instagram, and WhatsApp) versus its Reality Labs (metaverse) division for Q3 2022:

Meta faces unique challenges due to the evolving data landscape, with less to lose but a higher likelihood of losing what it has. Its advertising revenues are already taking a hit from Apple’s Ad Tracking Transparency initiative. Notably, Meta reported an 18% decline in CPM (Cost per thousand ad impressions) in Q3 2022, as user tracking has become less effective once they leave Meta platforms. Advertisers are increasingly inclined to allocate their budgets to platforms like Amazon, where tracking conversions is more straightforward.

Zuckerberg is not merely pursuing the metaverse out of boredom with Snapchat; he recognizes the future importance of owning a comprehensive ecosystem. Thus, the investment in headsets and virtual realms aims to track user behavior comprehensively.

While some analysts argue that younger audiences are more inclined to engage with VR, it’s crucial to note that the majority of children today lack disposable income. Interestingly, a recent report by The Guardian highlighted that participation in nature projects significantly boosts young people’s mental health and employability.

While we don’t inhabit a fantasy world where Meta would invest in such positive initiatives, that would be a far more admirable direction than their current metaverse ambitions. To date, they have allocated $15 billion towards metaverse projects—perhaps a metaverse tax should be proposed, redirecting those funds into real-world initiatives that yield tangible benefits.

Returning to our current reality, Meta's substantial gamble rests on the belief that the metaverse will eventually gain traction, positioning them to capitalize on its development, whatever that may entail.

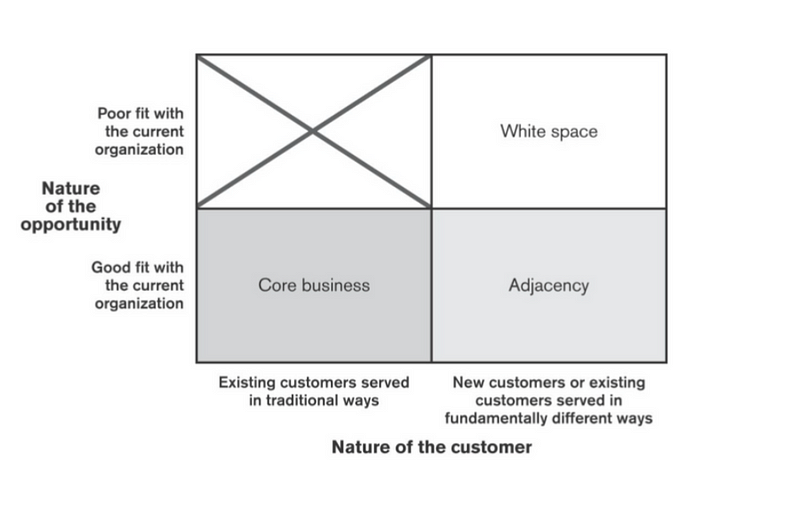

Revisiting the business model quadrant, we find:

- Alphabet is refocusing on its core strength: search ad sales, while also exploring adjacent opportunities like short-form video and cloud services. These ventures require investment but have a clear path to profitability in the near future. Wall Street seems to favor this strategy over Meta’s current approach.

- Meta appears to be pursuing a radically different strategy, heavily investing in the metaverse while trying to enhance video engagement on Facebook and adding more business-oriented features on WhatsApp. However, the data indicate a significant commitment to a metaverse strategy that seems increasingly disconnected from present economic realities, with little indication that the market desires their vision.

Nonetheless, just as we could have doubted the iPhone's potential, Zuckerberg is at least attempting to innovate.