Understanding Bitcoin's Place in the Financial Landscape

Written on

Chapter 1: Bitcoin as Digital Gold

Bitcoin is frequently referred to as "digital gold," a phrase that succinctly captures its essence. This analogy is fitting because, much like gold, Bitcoin requires significant time, resources, and energy to be mined. Moreover, it isn’t backed by any government, and it enjoys universal acceptance.

What sets Bitcoin apart is its ability to be transferred almost instantaneously across the globe, unlike gold, which is cumbersome and challenging to transport in large quantities. For instance, transferring a million dollars worth of Bitcoin can be done digitally without diminishing its value, making it far easier to store and transfer than gold.

Additionally, Bitcoin offers greater divisibility. You can mathematically divide Bitcoin, whereas with gold, you either need to cut a piece off or find a similarly sized coin to match your transaction. In some cases, moving the amount of gold you wish to trade could involve complex arrangements or contracts.

While gold is scarce, Bitcoin is finite, with a total supply capped at 21 million, making it scarcer than gold over the long term. Gold can be considered an analog asset, while Bitcoin represents a digital evolution. Though gold has proven its worth over millennia, Bitcoin could potentially offer even greater utility in the future due to its digital nature.

Ultimately, it’s important to recognize that Bitcoin isn't in direct competition with gold. They are both assets that can coexist, and while Bitcoin may surpass gold in certain aspects, gold's historical resilience in the face of currency fluctuations is noteworthy.

Description: An engaging debate featuring Natalie Brunell and Peter Schiff discussing the merits of Bitcoin and gold.

Section 1.1: Bitcoin and Fiat Currency

Bitcoin is not in opposition to fiat currencies, such as the US dollar. Rather, it is a byproduct of the current global macroeconomic landscape. While Bitcoin's value may appreciate against fiat currencies, it is not intended to replace them. Instead, it serves as an alternative asset characterized by properties that are less susceptible to manipulation compared to traditional currencies.

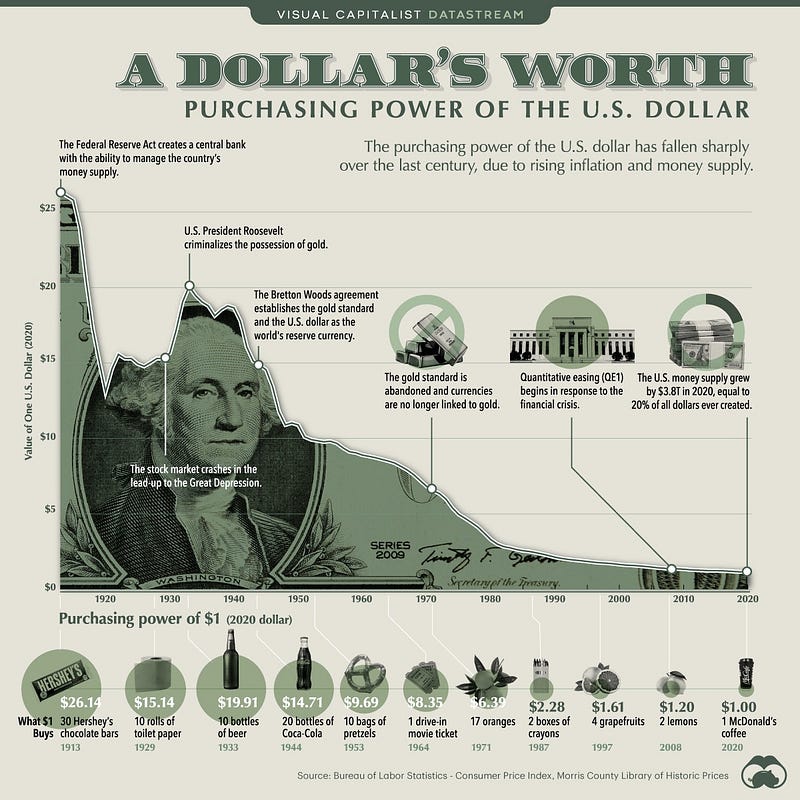

The value of fiat currencies often trends toward zero over a long timeframe, primarily due to the lack of production costs associated with their creation. Traditional currencies, including the US dollar, can be produced at virtually no cost, relying instead on the decisions of those in power.

In contrast, commodities like oil and gold have inherent production costs that can serve as a benchmark for their value. Bitcoin, classified as a “proof of work” cryptocurrency, similarly requires significant energy and resources for its creation. This shared characteristic with traditional commodities underscores Bitcoin's value proposition.

Subsection 1.1.1: The Consequences of Fiat Debasement

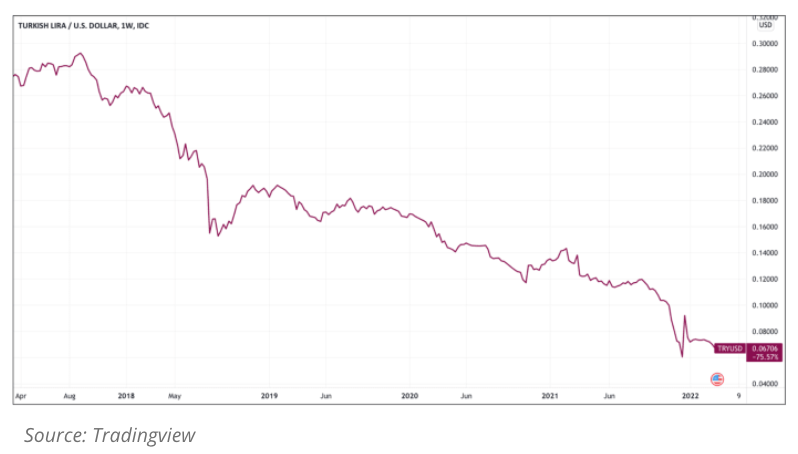

Despite the gradual decline in the purchasing power of the US dollar, it remains the world's reserve currency. This status will not change overnight; however, smaller fiat currencies are likely to fail first, as seen in Argentina and Turkey, where significant devaluations have occurred in recent decades.

Chapter 2: Historical Context of Currency

The phenomenon of currency debasement is not a recent development. Throughout history, inflation, economic crises, and unreliable governments have led to the downfall of various currencies. Notably, the Spanish dollar, or piece of eight, was one of the first global currencies, recognized for its uniformity and value, which facilitated trade across different regions.

Despite its initial success, the piece of eight eventually lost its value and was replaced by other currency forms, illustrating that all currencies are ultimately subject to failure.

Section 2.1: Bitcoin Compared to Oil and Energy Commodities

Historically, oil has served as a store of value, playing a crucial role in societal advancements. John D. Rockefeller revolutionized the oil industry in the late 1800s, showcasing its significance.

However, recent innovations have increased oil supply while diminishing its demand due to the rise of renewable energy sources. While Bitcoin is often likened to oil, it has a distinct advantage: its finite supply and increasing acceptance as a digital asset.

Description: A discussion on the ongoing comparison between gold and Bitcoin, exploring their respective roles in investment strategies.

What’s Next for Bitcoin?

Bitcoin stands apart from gold, fiat currencies, and oil, representing a novel technological advancement. It serves as a versatile tool with the potential for numerous applications, including being a safe haven during times of economic distress.

As the world continues to adapt to Bitcoin, its unique properties allow it to transcend borders and generations, establishing itself as a revolutionary asset.

Conclusion

In the coming years, Bitcoin's true value and utility will become clearer as it continues to interact with both fiat currencies and commodities. It's essential to recognize that Bitcoin is not competing with gold or the US dollar but rather reshaping how we think about value and currency in the modern economy.

For further insights and updates, consider subscribing to my newsletter. Thank you for reading!