Exploring the Future of Crypto: Is Cash Here to Stay?

Written on

Chapter 1: The Potential of Cryptocurrency

Cryptocurrency is often touted as the future replacement for cash. Yet, skepticism remains regarding its capability to take over as the next step in the evolution of money.

Liza Summer via Pexels: Will Crypto Transform the Economy?

Cash exists in various formats: coins, paper bills, debit and credit cards, and even mobile payments. Could blockchain technology be the next logical development in this progression? While blockchain holds significant potential to revolutionize our world, several pressing issues must be resolved before it can replace digital cash:

- The reliability of cash far exceeds that of unpredictable cryptocurrencies.

- Many innovators view crypto primarily as an investment rather than a currency.

- Average users will require stringent regulations to safeguard against potential scams.

Feel free to share your thoughts in the comments below!

The Importance of Reliability

The US Dollar Index (USDX) assesses the dollar's value against six major currencies: the Euro, Swiss Franc, Japanese Yen, Canadian Dollar, British Pound, and Swedish Krona. This index serves as a reliable indicator of the dollar's standing in the global market.

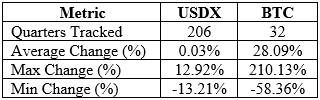

For the purpose of this discussion, Bitcoin (BTC) exemplifies cryptocurrency. Between 2013 and July 2022, Bitcoin accounted for at least 30% and as much as 96% of the total crypto market capitalization. Tracking for the USDX has been ongoing since January 1971, while Bitcoin's data has been monitored since September 2014. Below is a comparison of their quarterly value changes throughout their respective histories.

Table created by the Author: The evidence strongly suggests that the US Dollar possesses a more stable value compared to Bitcoin. Until users can confidently trust its value, cryptocurrency is unlikely to be widely accepted. Conversely, Bitcoin's appeal as a speculative investment remains pronounced.

How Is Bitcoin Currently Used?

As a nascent technology, Bitcoin sits within the technology adoption lifecycle, currently appealing predominantly to innovators and early adopters—approximately 16% of the population. This demographic typically engages with Bitcoin for short-term trading instead of everyday transactions.

This trend, however, doesn't hinder the evolution of crypto. The wider population is expected to utilize cryptocurrency in various ways, differing significantly from the initial adopters. Countless possibilities for cryptocurrency's future exist beyond its potential as a universally accepted currency.

Can Cryptocurrency Adapt?

Cryptocurrency is often associated with scams and fraud, a reality that cannot be overlooked. To protect average users and latecomers, regulation is essential. Yet, this need poses a philosophical dilemma for crypto purists, as decentralization and minimal government intervention are fundamental tenets of the technology.

The regulations necessary for mainstream acceptance of cryptocurrency, such as investor protections akin to those in the stock market, could fundamentally alter its original identity. Thus, cryptocurrency and its proponents face a critical question: are you prepared to relinquish some of your core principles to achieve mainstream status?

The Enduring Relevance of Cash

For now, cash remains dominant until a clear consensus emerges. Cryptocurrency may one day evolve to become a regulated mainstream currency, but its journey may already be hindered by cash's established reliability and convenience. These two aspects might steer cryptocurrency down an alternative path.

If you found this article insightful, consider signing up for Medium through my referral link.

Please contact [email protected] with any inquiries or suggestions for other personal finance topics to explore.

Chapter 2: Insights from the Experts

In the video titled "Too Late To Buy Crypto Altcoins?", experts discuss the viability and timing of investing in altcoins.

The video "Is It Too Late To Buy Bitcoin?" examines whether new investors have missed the boat on Bitcoin investments.