How Technology Influences Value Amidst Dollar Depreciation

Written on

Chapter 1: Analyzing Growth Trends

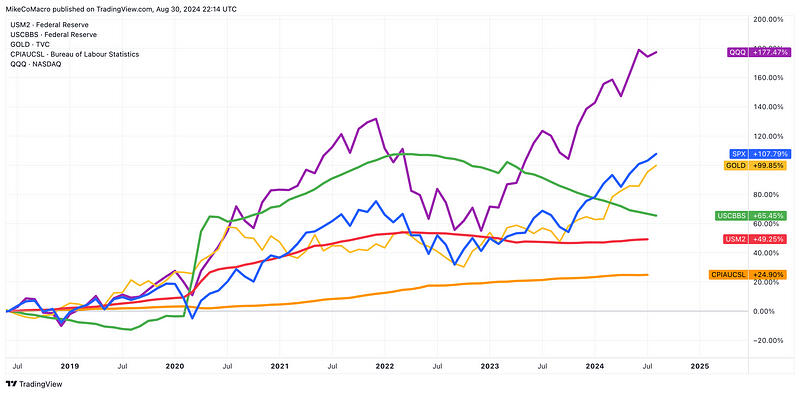

The S&P 500 and gold have both experienced extraordinary long-term gains, with increases nearing 7,000% since the early 1970s. While the stock market often exhibits volatility, gold tends to undergo periods of stagnation followed by rapid surges. Interestingly, over a span of 50 years, gold has marginally outperformed stocks. However, timing and dividends from stocks play crucial roles in these outcomes.

Consumer Price Index (CPI) data reveals a persistent decline in the dollar's purchasing power. Nevertheless, both the S&P 500 and gold have consistently outshone CPI over the decades.

Is there a relationship between the S&P 500 and gold as leading or lagging indicators of monetary trends? Recent charts suggest a near-exponential increase in money supply in 2020, a consequence of the Federal Reserve's aggressive dollar printing and bond purchases, reminiscent of actions taken during the Great Financial Crisis.

Section 1.1: Tech's Ascendancy

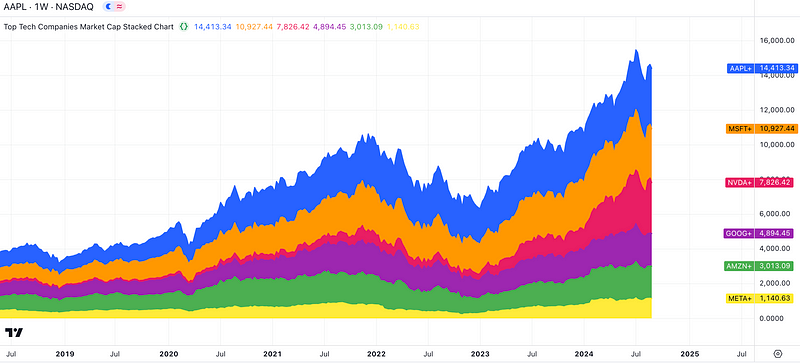

The technology sector has particularly thrived during these economic shifts.

Looking ahead at the macroeconomic landscape, predicting outcomes remains a challenge, yet historical patterns provide some guidance. It may only be a matter of time before monetary easing resumes. However, it’s important to remember that past performance doesn’t guarantee future results.

Subsection 1.1.1: The Importance of Timing

For investors, a strategy of diversification and proper timing is essential. For those who entered the tech market early, a more aggressive investment approach may have been warranted.

Chapter 2: Valuations and Economic Implications

The combined market capitalization of leading tech companies exceeds $14 trillion, surpassing the GDP of numerous nations and significantly outpacing nearly all other asset classes.

Will such tech valuations be maintained? Can we expect global GDP growth to continue? Let’s consider the widespread use of devices like those from Apple and Microsoft, as microprocessors advance towards a near-sentient state.

All the charts referenced are available for exploration and customization on TradingView. If you find my analysis helpful, please consider signing up through my partner link.

Disclaimer: The content provided here is intended solely for educational purposes and should not be interpreted as investment, legal, or tax advice.